SBA FastTrack®: Secure SBA Business Loans Quick & Easy

Experience fast track financing with expedited SBA loans up to $350k with 10-year terms.

SBA FastTrack® by Spartan: Key Features

SBA loans offer a guarantee from the federal government of 75% - 90% of the loan amount, making banks more comfortable lending and easier for under-collateralized businesses to get the funding they need.

Fast Track Financing with Speedy Approval

Experience the efficiency of our fast SBA loans, closing in as little as 14 to 30 days, putting the funds you need in your hands as quickly as possible.

Loans Tailored to Your Revenue

Obtain a business loan that's 33% of your gross revenue from your most recent tax filing, with a ceiling of $350,000, ensuring your financing aligns with your business scale.

Extended 10-Year Repayment Term

SBA FastTrack™ offers a generous 10-year term, ensuring your repayments are manageable and don't impede your cash flow.

Quick SBA Loans Up to $350,000

Fuel your business growth with rapid funds for payroll, marketing, operational expenses, and other essential working capital requirements.

SBA FastTrack®: Experience the Spartan Difference

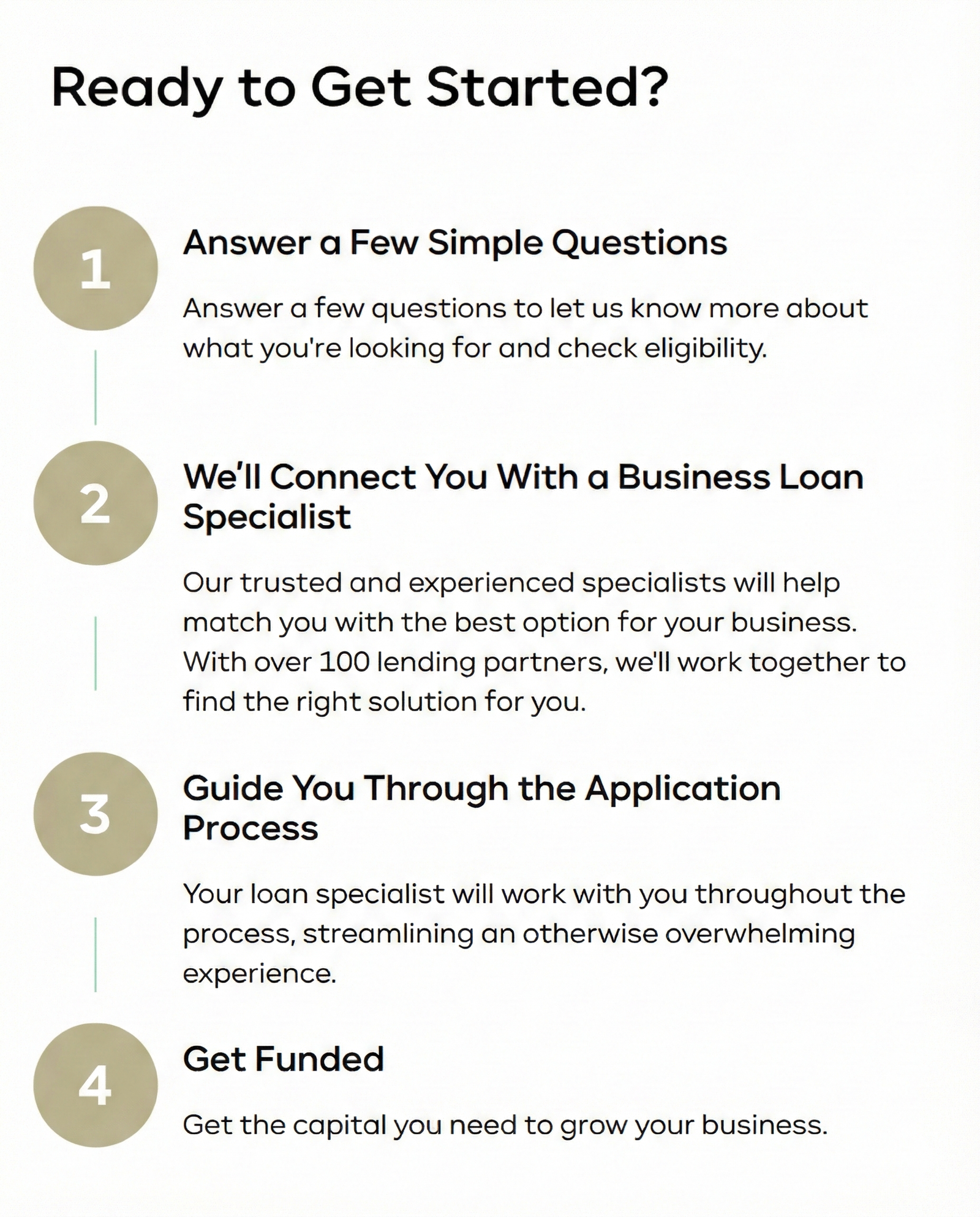

Hassle-Free Application

Dive into our simplified application process, designed to minimize the typical complexities of fast SBA loans, letting you concentrate on your business, not the paperwork.

Quick SBA Loans with Rapid Funding

With SBA FastTrack®, expect closing in as little as 14 to 30 days . Access the capital you need promptly, ensuring your business doesn't miss a beat.

Attractive Interest Rates

Boasting a competitive rate of Prime + 3%, our fast track loans ensure your business benefits from manageable repayments, free from the weight of exorbitant interest rates.

Guidance from SBA Specialists

Lean on our seasoned team of experts, always on hand to navigate you through the fast SBA loan process, answer queries, and ensure a smooth journey from start to finish.

Pre-Requisites for SBA FastTrack® Loan

Pre-Requisites for SBA FastTrack® Loan

What Distinguishes Spartan Cafe in Fast Track Financing

Why Choose Spartan for SBA FastTrack® Financing?

SBA FastTrack® by Spartan is more than just a quick SBA loan; it’s a catalyst for business transformation. Transition from the challenges of securing funds to enjoying the financial flexibility to grow your business. Move from watching opportunities slip by to confidently capitalizing on them. Shift from financial stress to the empowerment of making informed, strategic business decisions.

Your business deserves access to affordable capital. With SBA FastTrack®, you’re not just securing a business loan; you’re unlocking a brighter future. Let’s write the next chapter of your business success story together.

Have 5 Minutes? Apply Online

Check to see if you pre-qualify without impacting your credit score.