SBA Authorizes 100% Financing for Employee to Buy Business

Business owners can now sell their business to an employee with 100% financing.

SBA Employee Business Acquisition Loan Features

SBA loans offer a guarantee from the federal government of 75% - 90% of the loan amount, making banks more comfortable lending and easier for under-collateralized businesses to get the funding they need.

Program Purpose & Accessibility

Designed specifically to empower workforce succession, this loan program facilitates the seamless purchase of a business by its existing employees. It removes traditional barriers to entry, making it significantly easier for staff to transition into ownership roles and take over operations from their current employers.

Zero Down Payment Structure

One of the program's most significant advantages is the elimination of a down payment requirement for the acquiring employees. This unique feature allows employees to acquire the business without needing substantial personal capital upfront, democratizing the path to business ownership.

Favorable Financing Terms

The loan structure is highly leveraged to support the buyer, covering up to 90% of the total purchase price. To bridge the gap, the seller retains a note for the remaining 10%. Crucially, this seller note is placed on "standby" for the first 24 months, meaning no payments are required during this critical initial period.

Operational Continuity & Qualification

Beyond the financial benefits, the program is structured to ensure the business continues running smoothly during the ownership transition. It features minimal credit requirements compared to standard commercial loans, focusing instead on the continuity of operations and the employees' ability to maintain the business's success.

Acquire an Existing Business with Spartan's SBA Loans

Capital Preservation

Preserve Liquidity: This structure allows employees to purchase a business with 0% down. By removing the need for an upfront cash injection, buyers can keep their personal savings intact for future emergencies or personal investments.

Long-Term Affordability

Extended Loan Terms: To ensure the business's cash flow remains healthy, these loans offer extended repayment periods ranging from 10 to 25 years. These terms, combined with competitive SBA interest rates, result in significantly lower monthly payments.

High Borrowing Capacity

Large Loan Amounts: Facilitating substantial acquisitions, buyers can access up to $5 million in funding. This is achieved through a strategic combination of SBA-backed funds and conventional bank loans, making larger enterprises accessible to internal buyers.

Inclusive Qualifications

No Minimum Credit Requirement: Accessibility is a core feature of this program, as there is no specific minimum credit score required to qualify. This opens the door for dedicated employees with diverse financial backgrounds to transition into ownership.

Asset Protection

No Personal Collateral: One of the most significant safeguards for the buyer is that the loan does not require personal assets (such as a primary residence) to be pledged as collateral. This separates personal risk from the business acquisition.

Comprehensive Funding Utility

Flexible Use of Funds: The capital provided is not limited to the purchase price alone. It can be used for a wide array of operational needs, including working capital, inventory, equipment, real estate, and renovations, ensuring the business is well-funded from day one.

Pre-Requisites for SBA FastTrack® Loan

What Sets Us Apart

Why an SBA Business Acquisition Loan?

If you want to purchase an existing business, an SBA employee business acquisition loan may be right for you.

While conventional banks often require large down payments and unfavorable terms, Spartan helps you purchase an existing business or franchise with 10 years terms and reasonable monthly payments.

We’ve helped hundreds of people get approved for business acquisition loans using SBA-backed financing with favorable terms.

Benefits of a Employee Business Acquisition Loan

Whether you’re just getting started or expanding, a business acquisition loan can be tailored to meet your needs.

- Obtain a business loan without collateral

- Diverse financing options

- Protect your cash flow

- Bypass the start-up phase and own a mature business

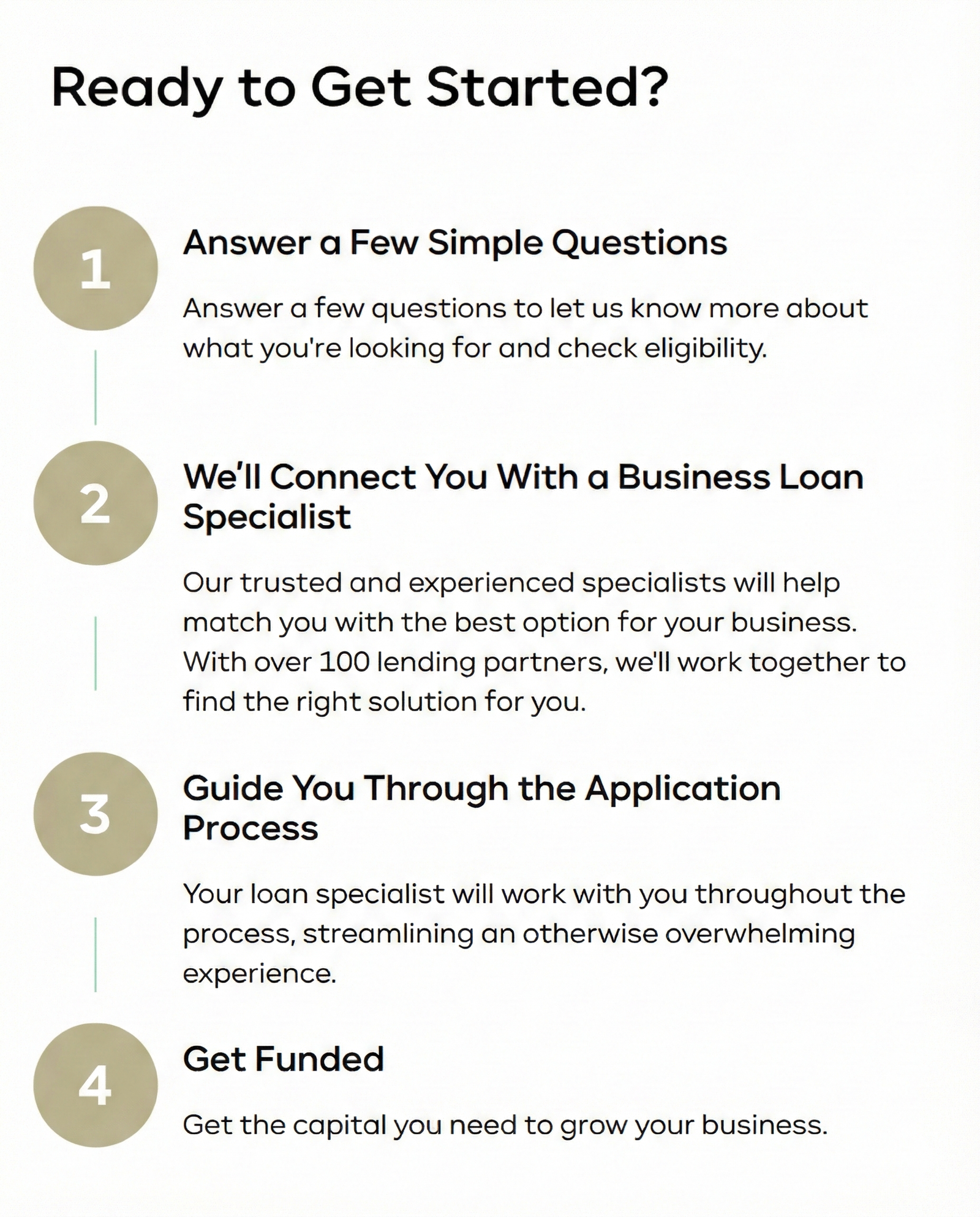

Have 5 Minutes? Apply Online

Check to see if you pre-qualify without impacting your credit score.