Buy a Business with SBA-Backed Financing

Access SBA loans for business acquisition with minimal equity injection and favorable terms.

SBA Business Acquisition Loan Features

SBA loans offer a guarantee from the federal government of 75% - 90% of the loan amount, making banks more comfortable lending and easier for under-collateralized businesses to get the funding they need.

Preserve Liquidity

Acquire an established, profitable business with minimal cash required up front.

Buy a Business With Real Estate

Gain the stability of a fixed location, avoid rent increases, and receive tax benefits with equity appreciation.

Extended Loan Terms

Enjoy lower payments with loan terms of 10-years to 25-years and SBA-backed interest rates.

Loans Up to $10 Million

Pursue larger acquisitions with the simultaneous closing of an SBA loan and a conventional bank loan.

Acquire an Existing Business with Spartan's SBA Loans

Save Time

Buying an existing business means you don't have to start from scratch, so you can hit the ground running and start generating revenue immediately.

Reduce Risk

An established business has a track record of success, which means you can assess its potential and risks before making a purchase.

Increase Revenue

With the right acquisition, you can increase your revenue and profits in a shorter amount of time.

Pre-Requisites for Business Acquisition Loan

Pre-Requisites for SBA FastTrack® Loan

What Sets Us Apart

Why an SBA Business Acquisition Loan?

If you want to purchase an existing business, an SBA business acquisition loan may be right for you.

While conventional banks often require large down payments and unfavorable terms, Spartan helps you purchase an existing business or franchise with 10 years terms and reasonable monthly payments.

We’ve helped hundreds of people get approved for business acquisition loans using SBA-backed financing with favorable terms.

Benefits of a Business Acquisition Loan

Whether you’re just getting started or expanding, a business acquisition loan can be tailored to meet your needs.

- Obtain a business loan without collateral

- Diverse financing options

- Protect your cash flow

- Bypass the start-up phase and own a mature business

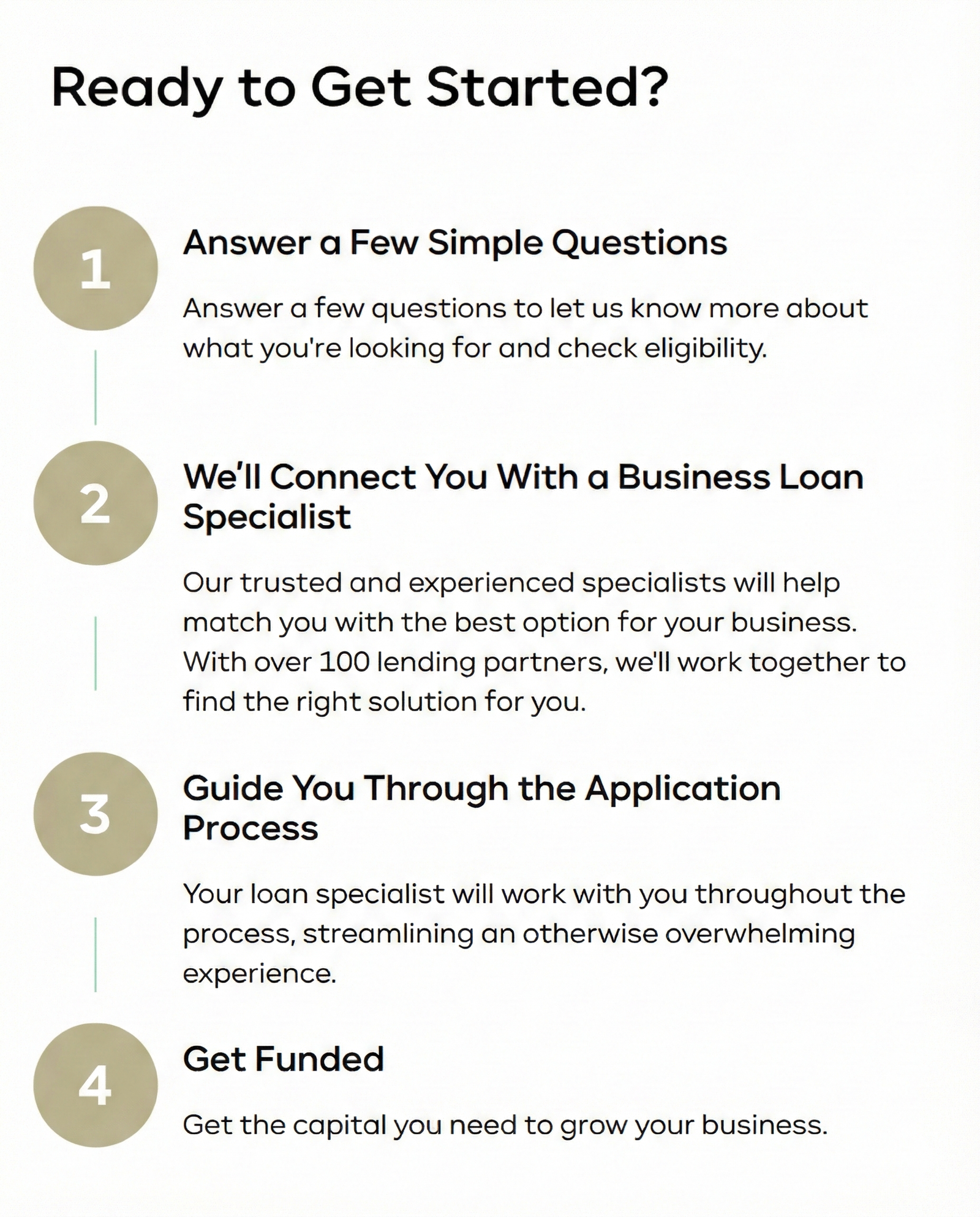

Have 5 Minutes? Apply Online

Check to see if you pre-qualify without impacting your credit score.