Ignite Your Business with SBA Boost® by Spartan

Up to $500k in 30 days for working capital, equipment, inventory, debt refinance and more.

SBA Boost™ Loan Features

SBA loans offer a guarantee from the federal government of 75% - 90% of the loan amount, making banks more comfortable lending and easier for under-collateralized businesses to get the funding they need.

Grow Your Business

Expand your business by refinancing debt, buying equipment, purchasing inventory and obtaining working capital.

Flexible Guidelines

More business owners can qualify with flexible debt service coverage ratio requirements and a minimum FICO score of 640.

10-Year Payment Terms

Extended repayment terms provide lower monthly payments and increase cash flow for your business.

Loans up to $500,000

Make significant investments in your business; expand and accelerate your growth with up to $500k in 30 days.

SBA Boost®: The Spartan Advantage

Boost Working Capital

Get the working capital you need to cover daily expenses, manage payroll, and navigate fluctuating market conditions.

Hire More Employees

Grow your team and recruit top talent while creating jobs for your local community.

Increase Inventory

Expand inventory to meet customer demand and maintain a healthy supply chain to improve your bottom line.

Upgrade Equipment

Purchase or upgrade the equipment you need to improve your business's productivity and stay ahead of the competition.

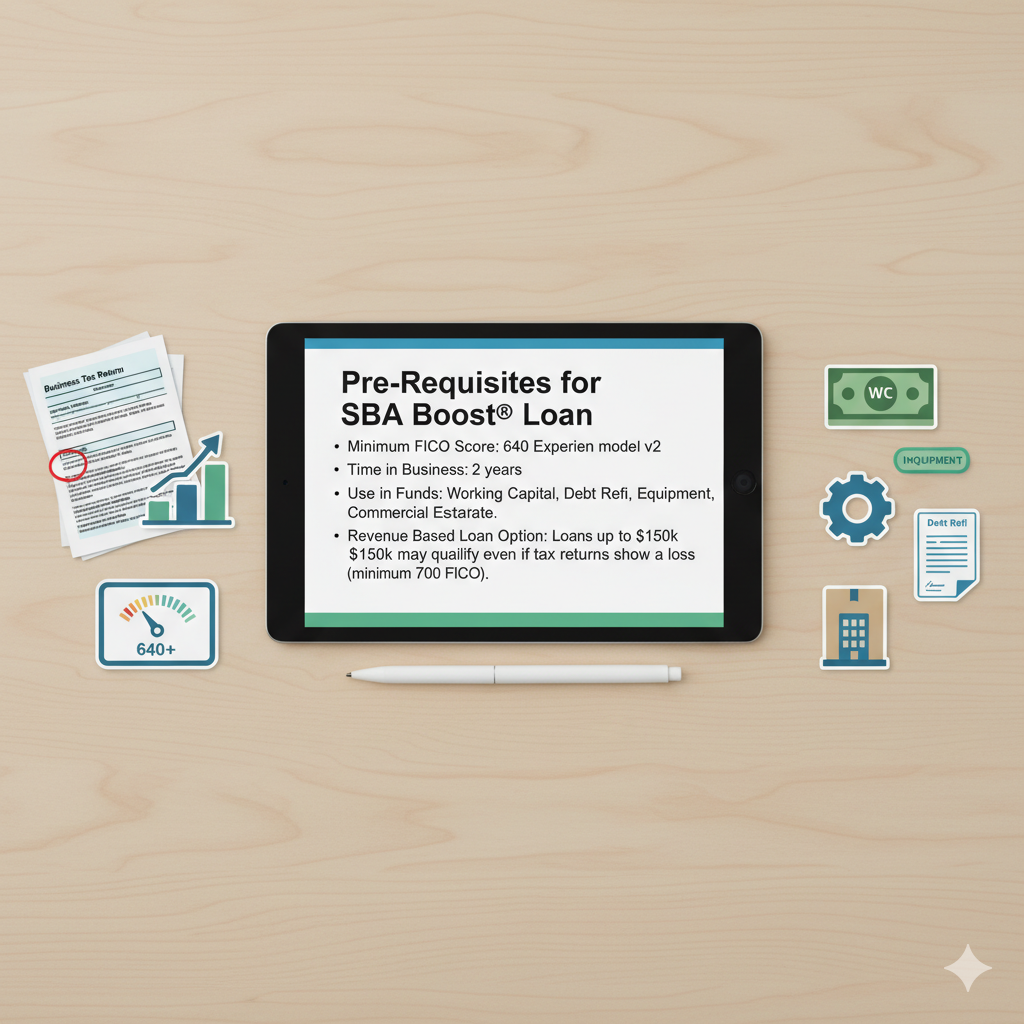

Pre-Requisites for SBA Boost® Loan

Pre-Requisites for SBA FastTrack® Loan

What Sets Us Apart

Trusted Lending Partner

As a trusted SBA lending partner, we understand the importance of providing reliable and accessible financing options to small businesses. Our commitment to helping entrepreneurs succeed is reflected in our comprehensive suite of SBA loan products and services.

Our experienced team of SBA lending specialists is dedicated to assisting small business owners throughout the loan application and approval process. We work closely with each borrower to tailor loan packages that meet their specific needs, from startup capital to expansion financing.

With over 100 years of combined SBA lending experience, our team will be your advocate and guide you to a successful loan funding.

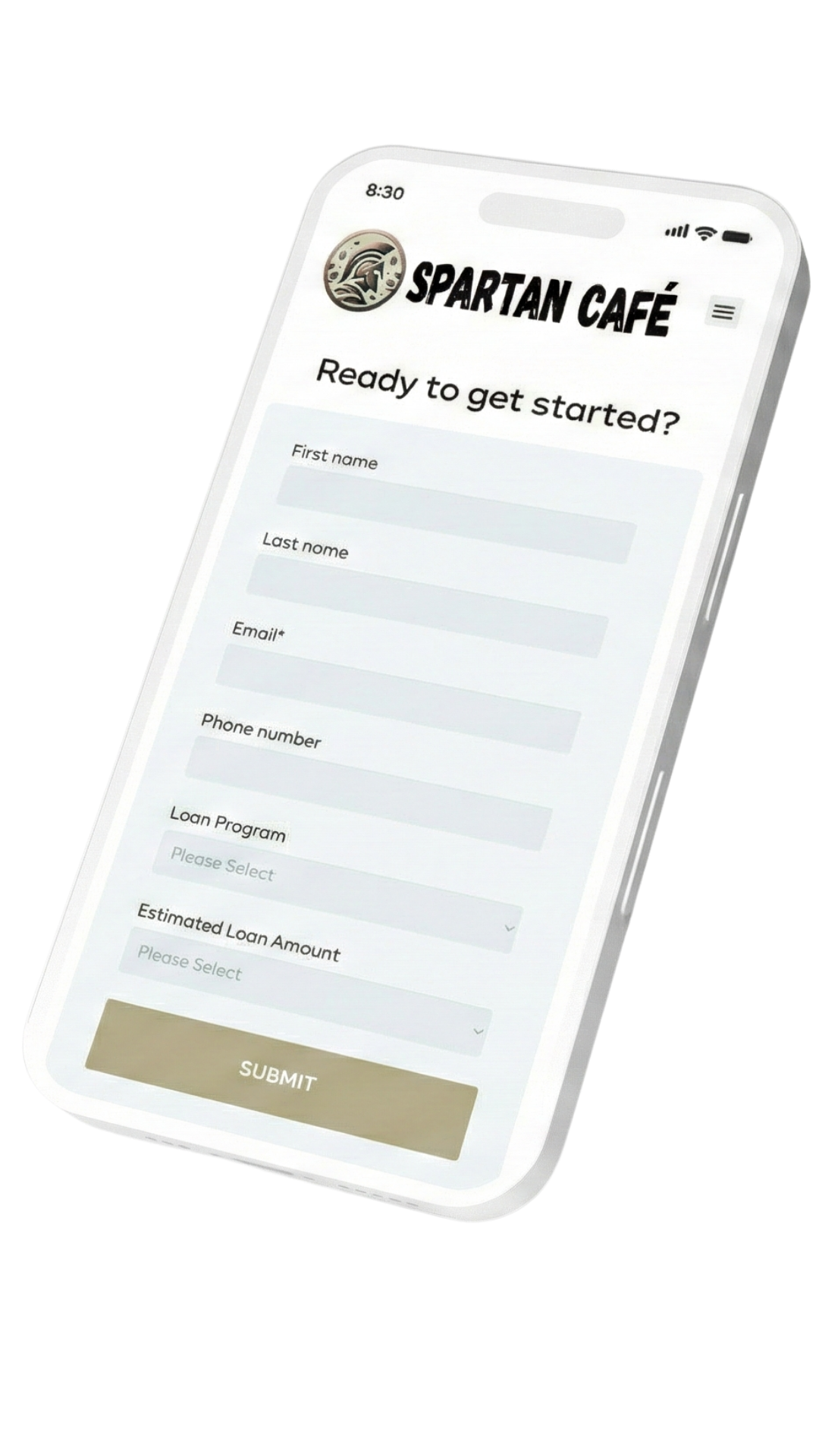

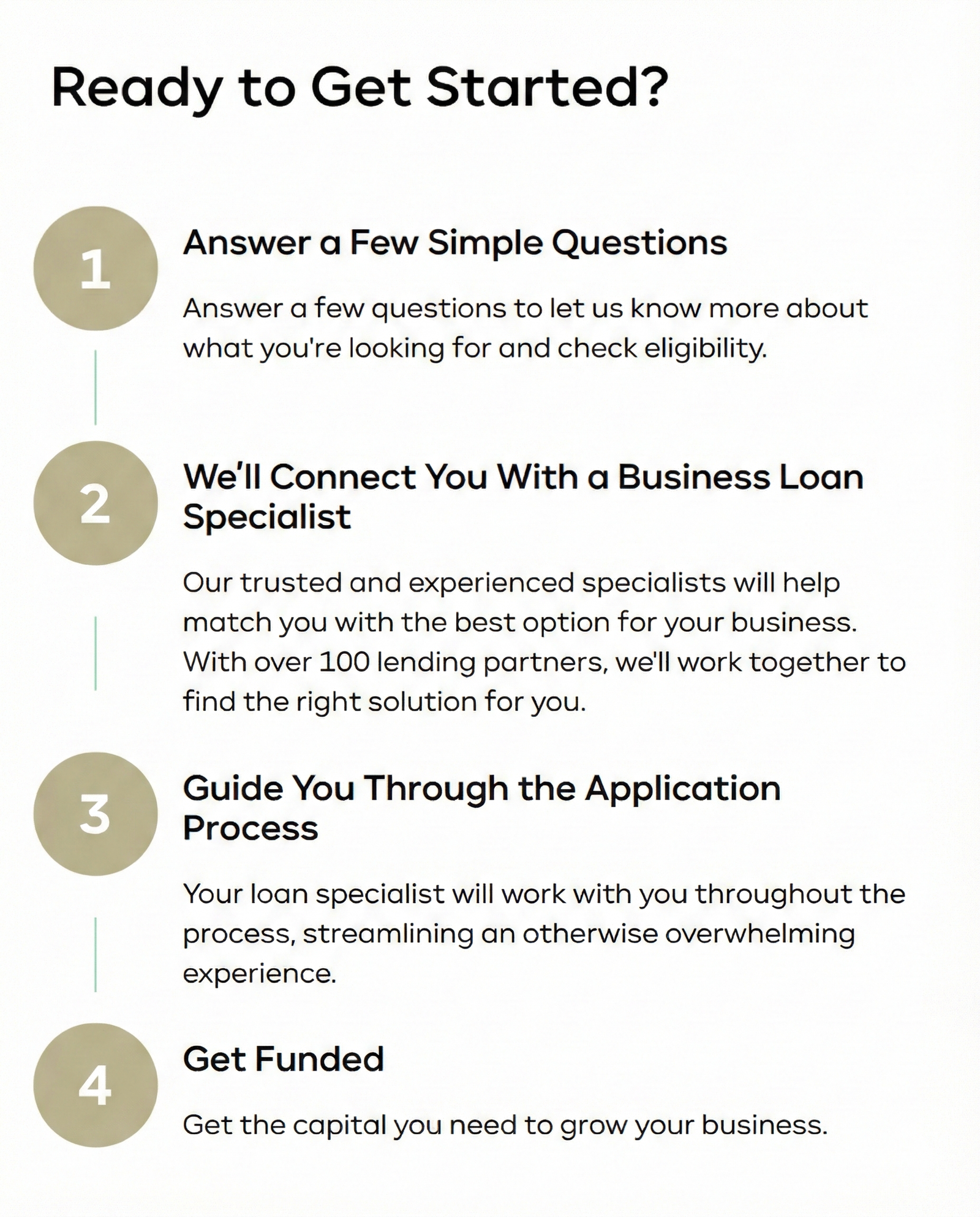

Have 5 Minutes? Apply Online

Check to see if you pre-qualify without impacting your credit score.